Blockchain technology is rapidly transforming accounting practices, offering unprecedented levels of transparency and security. Imagine a world where financial transactions are recorded on an immutable and shared ledger, accessible to all authorized parties. This innovative approach to record-keeping has already started shaking up traditional accounting processes. Many accountants face challenges keeping up with the rapid changes in technology. This article will delve into the impact of blockchain on accounting practices, exploring the benefits, challenges, and practical applications of this transformative technology. We’ll cover how blockchain enhances transparency, security, and efficiency in financial transactions. We will also discuss the potential obstacles and challenges that businesses must address to fully leverage the power of blockchain. Finally, we will touch upon the crucial role of accountants in navigating this new landscape. This article is structured to provide a clear understanding of blockchain’s effect on the accounting profession.

Enhanced Transparency and Traceability

Streamlining Financial Processes

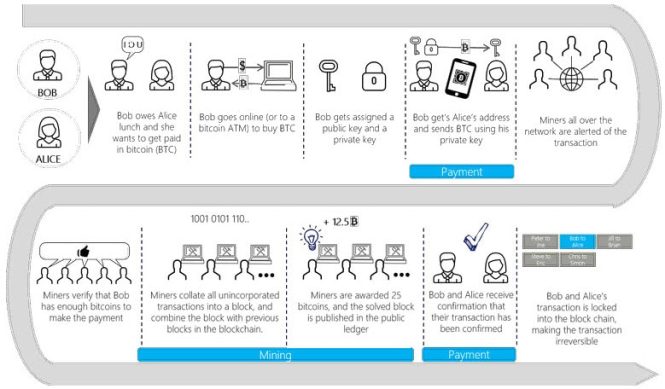

Blockchain’s decentralized nature fundamentally alters how financial transactions are recorded. Instead of relying on a single central database, transactions are recorded on a distributed ledger, making them transparent and traceable. Every participant has access to a complete and verified record of transactions, fostering trust and accountability. Imagine a scenario where every financial transaction, from supplier payments to customer invoices, is recorded immutably on a shared ledger. This level of transparency fosters greater trust among all parties involved.

Increased Security

The cryptographic security inherent in blockchain technology dramatically reduces the risk of fraud and data manipulation. The cryptographic security of blockchain protects sensitive financial data, decreasing the chances of fraudulent activities. This enhanced security boosts the confidence of all stakeholders in the integrity of financial records, eliminating the vulnerabilities that traditional methods have faced. Transactions are secured with cryptographic hashes and digital signatures, guaranteeing data integrity and preventing alterations or forgeries.

Revolutionizing Financial Reporting

Automating Processes

Blockchain’s potential extends to automated accounting processes, streamlining many aspects of financial reporting. Smart contracts, self-executing agreements with the terms defined in code, can automatically trigger actions based on pre-defined conditions. This streamlines processes like payment reconciliations and invoice approvals, freeing up valuable time and resources.

Improved Efficiency

Increased automation and transparency lead to better efficiency in financial reporting. This can result in faster audit cycles, reduced error rates, and more timely financial statements. Consider a scenario where invoices are automatically processed and reconciled once the specified conditions are met, eliminating the need for manual intervention.

Challenges and Obstacles

Scalability Issues

One key concern with blockchain is scalability. As more transactions are processed, the network’s capacity must keep pace. While ongoing improvements are being made, current limitations can affect the speed and efficiency of certain applications, especially for high-volume transactions.

Integration with Existing Systems

Migrating from traditional accounting systems to blockchain-based solutions can be a complex process. Companies face the challenge of integrating their current systems with blockchain technology, requiring significant resources for implementation. A clear implementation strategy is crucial.

Future of Accounting

Enhanced Audit Procedures

Blockchain technology also holds significant implications for audit procedures. The immutability and transparency of blockchain records allow for more comprehensive and efficient audits. The immutable record of blockchain transactions allows for more thorough audit trails that can verify every financial step. The ability to trace transactions back to their source reduces the chances of discrepancies and improves the overall accuracy of financial statements.

New Roles and Skills

The adoption of blockchain in accounting necessitates a shift in skills and roles. Accountants need to develop new competencies in blockchain technology, potentially leading to the emergence of specialized roles. Accountants require new skills to effectively apply blockchain solutions in their daily work, and training programs are essential to ensure accountants are prepared.

Practical Applications

Supply Chain Management

Blockchain’s capabilities extend beyond financial accounting. Within supply chains, tracking goods from origin to consumer can be vastly improved through immutable records on a shared blockchain, addressing issues like counterfeiting and product provenance. Transparency in supply chains boosts trust among stakeholders. By establishing transparent and verifiable supply chains, industries can enhance security and combat fraud.

Cross-Border Transactions

Cross-border transactions can benefit from the streamlined processes enabled by blockchain. The platform eliminates intermediaries, reduces transaction costs, and speeds up the payment process, resulting in increased efficiency and lower costs. Blockchain technology can enhance trust and efficiency in international business transactions.

Frequently Asked Questions

What are the key benefits of using blockchain in accounting?

Blockchain technology offers several significant advantages to businesses and individuals. Enhanced security through cryptographic procedures and the reduced risk of data breaches are crucial factors. The transparency provided by blockchain ensures accurate records and accountability among parties. The speed and efficiency of transactions and reporting can also improve significantly. Blockchain has the potential to drastically reduce operational costs and ensure accurate reporting.

What are the main challenges in implementing blockchain for accounting?

Despite the numerous benefits, implementing blockchain in accounting systems poses certain challenges. Integrating existing systems with blockchain technology can be complex and time-consuming. Scalability issues can arise, and the need for specialized personnel with blockchain expertise is paramount. The sheer complexity of building a blockchain-based accounting system can deter many businesses.

In conclusion, blockchain technology is revolutionizing accounting practices, offering enhanced transparency, security, and efficiency. By adopting these new methodologies, accountants and businesses can embrace the future of finance. This adoption requires continuous learning and adaptation. The future of accounting is digital, and embracing blockchain is no longer an option, but a necessity for long-term financial success. For a deeper dive into specific implementation strategies, consult industry resources and seek expert advice. Consider attending workshops or online courses for a comprehensive understanding of these new tools and techniques. This knowledge will be invaluable for staying ahead in the evolving accounting landscape.