Managing inventory accurately is paramount for any retail business seeking profitability and success. Inventory accounting, when done well, provides a clear picture of your stock levels, costs, and overall financial health. This article will explore key strategies for efficient inventory accounting in your retail business.

Effective inventory accounting goes beyond simply counting your stock. It involves a comprehensive system for tracking inventory movements, calculating costs, and ensuring accuracy in your financial records.

Understanding your inventory costs is essential. This encompasses the initial purchase price, handling fees, and storage expenses. Accurate cost accounting allows you to determine the selling price that will ensure profitability.

Implementing a robust inventory tracking system is key. Consider barcode scanning, RFID tags, or inventory management software. These tools automate data entry and reduce the risk of human error. Accurate data helps you make smarter business decisions.

Regular inventory audits are vital for maintaining accuracy. These audits compare your physical inventory against your records. Any discrepancies should be investigated and corrected to prevent potential accounting errors and ensure your records reflect reality.

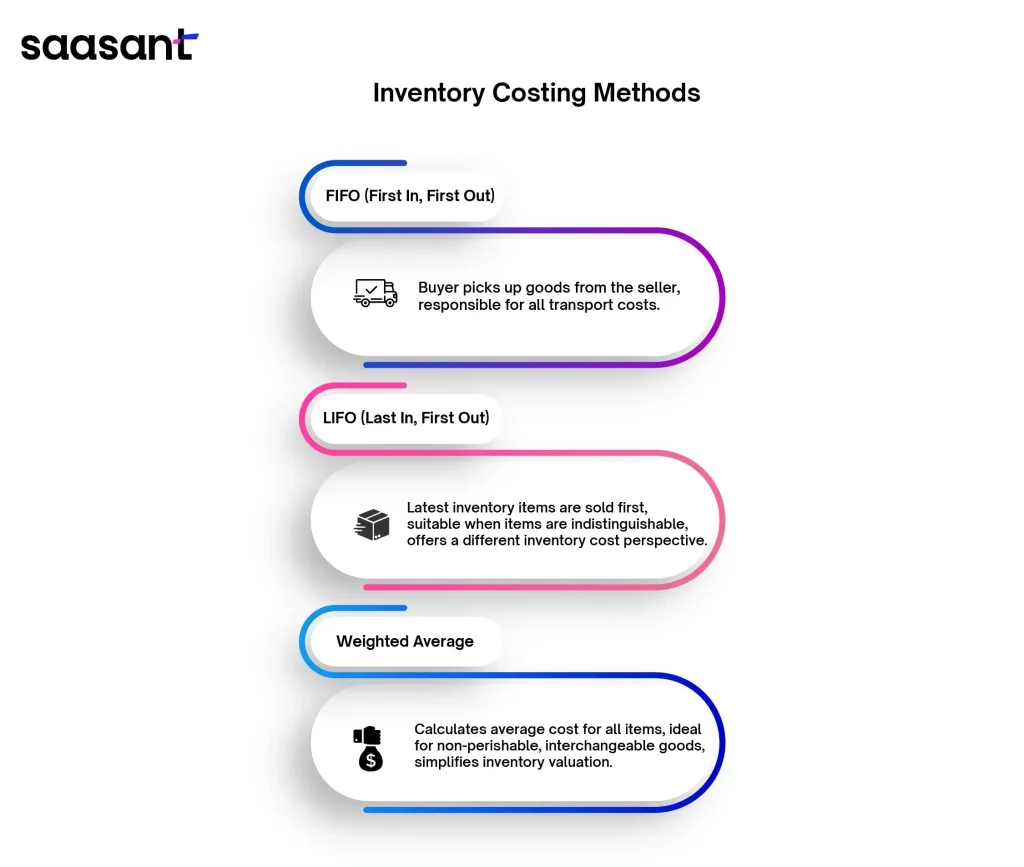

Use appropriate accounting methods. FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two common methods. Choose the one that best reflects your inventory flow, and always ensure your chosen method is consistently applied.

Accurate inventory accounting also involves meticulous record-keeping. Document every purchase, sale, return, and transfer of inventory. Detailed records are invaluable for financial reporting and analysis.

Utilizing accounting software can streamline the process significantly. Many software options offer automated tracking, reporting, and analysis capabilities. These tools can free up your time and resources for other crucial business tasks.

Analyze your inventory turnover rate. This metric shows how quickly you sell your inventory. A low turnover rate might indicate overstocking, while a very high rate could suggest insufficient stock to meet customer demand.

Staying informed about industry best practices and regulations is paramount. Ensure your inventory accounting procedures comply with all relevant laws and standards. This minimizes potential compliance issues and protects your business’s financial health in the long run and prevents potential legal troubles for the future, and helps you stay on top of the latest inventory accounting methodologies. Regularly seek guidance from experienced financial professionals when needed. Be sure to factor in potential tax implications related to your inventory accounting system for optimal savings and accuracy in your tax filings as well as potential legal troubles related to the current tax laws in effect for your business location and tax filings. The current government tax laws vary across regions and countries, so always consult with relevant professionals and tax advisors, and ensure your business operations and accounting procedures are in accordance with the relevant, current laws and regulations for your business and location in place for financial and inventory record-keeping practices and legal requirements for inventory accounting. Understand, and be prepared for, any potential tax implications for your business due to inventory management decisions made or applied. Remember to consult with financial and legal professionals to stay up-to-date with any changes to tax laws and regulations regarding inventory accounting procedures for better financial stability. Always be prepared for any potential changes in the tax regulations related to inventory accounting. Understanding and adapting to such changes is crucial to maintaining a consistent and legally sound inventory accounting system. Avoid potential tax implications by consulting with qualified tax advisors to stay well-informed about and up to date with any changes to the relevant accounting procedures and tax laws. Don’t neglect to consult with relevant professionals to make sure your accounting and inventory processes are compliant and legally sound. Be prepared for potential tax implications by seeking guidance from experienced financial professionals to manage your business with an appropriate inventory and financial management plan in mind, including how this affects your bottom line and potential tax implications. Stay aware of any pending changes to tax regulations or laws. Always consult with financial and legal professionals for any concerns or uncertainty regarding inventory accounting, and make sure you have the most updated and best current practices when it comes to inventory accounting. Consult with legal professionals to ensure compliance with applicable laws in the inventory accounting system for your retail business and stay informed about the latest tax regulations that relate to inventory accounting procedures to ensure your tax filings are sound and compliant. Be aware of potential tax liabilities related to inventory accounting methods and consistently seek professional assistance when needed. Always comply with the latest and applicable tax and accounting laws to ensure proper record-keeping procedures and processes are up to date and legally compliant. Consider and anticipate potential tax implications and changes in the regulations related to inventory accounting and stay well-informed. Avoid potential problems that may impact your tax filings and your bottom line, by ensuring your inventory accounting methods comply with tax laws and procedures. Take advantage of accounting software and solutions to optimize your efficiency and compliance processes for inventory accounting. Consult with professional accountants and tax advisors to ensure accuracy in tax filings and to properly manage your inventory accounting system to reduce the risk of any errors that may have potential legal implications and help maintain compliance with all related accounting and tax procedures and laws, and to ensure consistency with current procedures and regulations. Ensure all aspects of your inventory accounting system are consistent with all current laws and best practices to ensure the legal soundness of your processes. Consult and seek assistance from experts and professionals to ensure adherence to the current laws, and keep abreast of any changes or updates. Seek legal and professional financial advice to ensure your inventory management practices are sound in the event of potential tax or financial discrepancies, and ensure your business operates within the bounds of legality and compliance to ensure a successful and profitable business venture. Understand the implications of different inventory valuation methods. Evaluate your choices, and always seek professional guidance if necessary. Be informed about the current tax implications of your choices for your financial reporting. Carefully study the latest accounting and tax regulations and be mindful of the implications to your financial filings. Understand the implications to ensure your methods are legally sound and comply with regulations and current tax laws.

In conclusion, effective inventory accounting is crucial for the success of any retail business. By implementing the strategies discussed here, you can streamline your processes, improve accuracy, and ultimately boost profitability. Remember to adapt these methods to your specific business needs and regularly review your inventory accounting procedures to ensure they remain effective and aligned with your current operations.