Financial modeling is a cornerstone of strategic decision-making in today’s business world. Whether you’re a seasoned executive or a budding entrepreneur, understanding its fundamentals can give you a significant edge in navigating the complexities of the financial landscape. This article delves into the key concepts of financial modeling, focusing on how it applies to businesses today.

Understanding financial modeling isn’t about becoming a certified accountant, but rather acquiring the tools to interpret financial data and make proactive choices. It’s about gaining a deeper understanding of your company’s financial health, both in the present and in the future.

At its heart, financial modeling is a process of creating mathematical representations of a company’s financial situation. This involves projecting future performance based on various assumptions and using different methods, such as discounted cash flow (DCF) analysis, to assess value and potential returns.

A critical foundation of financial modeling is a strong grasp of accounting principles. Understanding the different types of financial statements—income statements, balance sheets, and cash flow statements—is essential. These statements provide a snapshot of a company’s financial position and performance, and are used as inputs into models.

A key element in financial modeling is forecasting. Projecting future revenue, expenses, and cash flows allows businesses to anticipate potential challenges and plan accordingly. This forward-looking perspective enables informed decision-making regarding pricing strategies, production levels, and resource allocation.

Valuation is another key aspect of financial modeling. Models can be used to determine the intrinsic value of a company or a particular investment. This understanding can help in making strategic investment decisions, such as acquisitions, mergers, or new product launches.

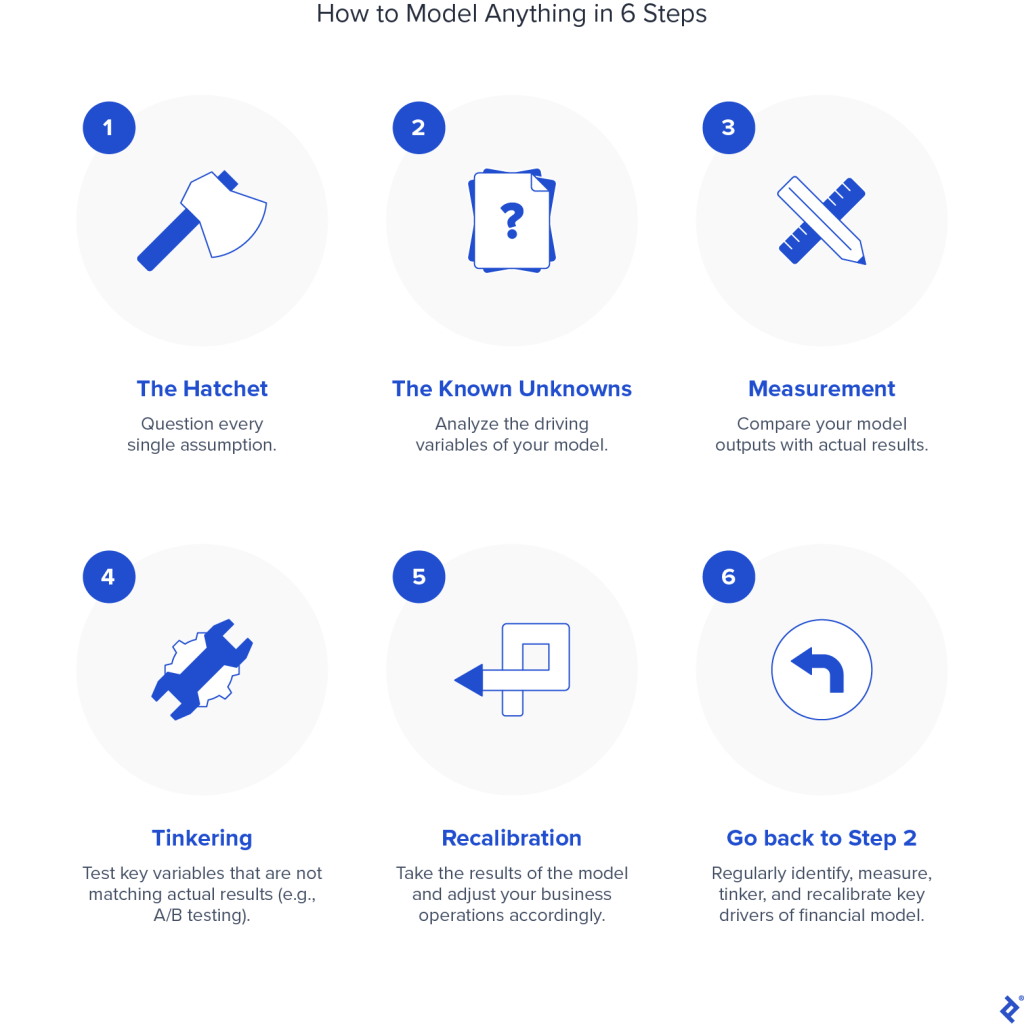

Financial models are not static documents but rather dynamic tools. They are used to test different scenarios and assess their impact on financial performance. This is often accomplished through sensitivity analysis, allowing decision-makers to quantify the potential effects of different variables.

Beyond the technical aspects, building a strong financial model requires a good understanding of the industry in which the business operates. Market trends, competitive pressures, and economic forecasts all play crucial roles in the accuracy and relevance of the model.

Incorporating data from various sources, like industry reports and market research, into the modeling process can significantly increase accuracy. This integration of external information allows for more comprehensive and informed projections.

By employing sensitivity and scenario analyses, businesses can evaluate how different factors—such as changes in interest rates, raw material prices, or market competition—might affect their financial performance. These analyses provide a broader view of potential risks and opportunities. Sensitivity analysis evaluates the impact of one or more factors at a time, while scenario analysis considers various combined scenarios and their repercussions. This method enables a more holistic and comprehensive understanding of the situation, rather than relying on a single, static projection. Understanding these variations is crucial for risk management and strategic planning. These tools also inform decision-making, allowing businesses to prepare for challenges and seize opportunities. Therefore, they are essential for maintaining a competitive edge in today’s dynamic market environment. Ultimately, this process builds resilience into the business’s financial strategies, allowing it to adapt to change and emerge stronger in the future. Thus, understanding sensitivity and scenario analysis is paramount to success in the complex business world today. These concepts form the backbone of successful financial modeling—they enable firms to not only anticipate challenges but also capitalise on opportunities. A thorough comprehension of these tools is vital for making intelligent, forward-thinking business decisions. This enables the creation of a strong foundation for future financial success and growth. Further, understanding sensitivity analysis and scenario analysis in financial modeling allows companies to make strategic decisions based on informed projections. Therefore, a profound understanding of these analytical techniques is crucial for navigating the intricate challenges and opportunities in today’s business climate effectively.

In summary, grasping financial modeling fundamentals empowers businesses to make well-informed decisions, anticipate future challenges, and ultimately, achieve sustainable growth. A strong understanding of these principles, coupled with continuous learning and refinement, is crucial for navigating the complexities of today’s financial landscape.