Strategies for using accounting to improve your business valuation plan are crucial for entrepreneurs looking to maximize the value of their ventures. A well-defined accounting system not only accurately reflects the financial health of a business, it also forms the basis for informed valuation decisions. Unfortunately, many entrepreneurs struggle with translating their accounting data into a persuasive valuation narrative, hindering their ability to secure funding, attract investors, or execute successful mergers and acquisitions. This comprehensive guide will equip you with proven strategies to effectively leverage accounting to improve your business valuation plan. We’ll delve into various accounting methods, highlight essential financial metrics, and demonstrate how accurate financial reporting can directly translate into a stronger business valuation. This article will detail critical aspects, from understanding core accounting concepts to applying them to practical valuation situations.

Understanding the Fundamentals of Accounting for Business Valuation

Core Accounting Principles:

Accounting principles provide the bedrock for accurately representing a company’s financial position and performance. These principles, such as the matching principle and the going concern principle, ensure consistency and reliability in financial reporting. This reliability is paramount in business valuations as it allows for a clear and unbiased evaluation of the company’s true worth. Understanding the principles behind accounting is vital for confidently building a comprehensive valuation plan, which in turn influences investor decisions. Without a robust accounting foundation, any valuation approach risks being unreliable and inaccurate. Adherence to generally accepted accounting principles (GAAP) is critical. Misleading or inconsistent accounting practices can significantly skew the valuation result, leading to potentially incorrect decisions.

Analyzing Financial Statements: The Key to Accurate Valuation:

Understanding financial statements is paramount for conducting a sound business valuation. A thorough analysis allows you to identify trends, predict future performance, and assess the overall financial health of the company. Financial statements include the balance sheet, income statement, and cash flow statement. Each provides unique insights into different aspects of the business—balance sheets offer a snapshot of assets, liabilities, and equity; income statements track revenues and expenses over a period; and cash flow statements analyze the movement of cash into and out of the business. By scrutinizing these statements, you can uncover potential risks, strengths, and weaknesses. Consider a retail clothing business struggling to maintain inventory levels—analyzing the cash flow statements will highlight the difficulty in managing cash flow.

Implementing Best Practices in Accounting for Valuation Enhancement

Maintaining Accurate Financial Records:

Maintaining accurate financial records is crucial for a reliable valuation. This includes tracking transactions meticulously, ensuring that all transactions are properly documented and categorized. Consistent record-keeping also supports a solid and predictable financial projection process, making it easier to anticipate future performance. Consider a small bakery; detailed tracking of ingredient costs and sales figures is essential to understand profitability and predict future revenue streams. Without this meticulous approach, future valuations become imprecise and less persuasive. Properly documented transactions, consistent application of accounting procedures, and reliable reporting contribute to an accurate and trustworthy valuation.

Establishing Robust Internal Controls:

Robust internal controls safeguard financial data and ensure accuracy. This involves segregating duties, implementing authorization procedures, and implementing regular audits. These controls minimize the risk of errors and fraud. Implementing stringent internal controls in a manufacturing company, for instance, ensures accurate tracking of production costs, inventory levels, and revenue recognition. The prevention of accounting errors, which can skew valuation results, is a critical element of this process.

Utilizing Financial Metrics for Enhanced Valuation

Key Performance Indicators (KPIs) in Valuation:

Key Performance Indicators (KPIs) play a vital role in evaluating a company’s performance. Identifying and tracking relevant KPIs provide a deeper understanding of how your business performs within its industry. For instance, a software company might use revenue per user or customer lifetime value. Analyzing these metrics along with accounting data will reveal potential issues in a company’s operations or efficiency. This analysis provides a more nuanced view than financial statements alone.

Leveraging Financial Ratios for Valuation Analysis:

Financial ratios provide valuable insights by comparing different financial aspects of a company. These ratios help quantify profitability, liquidity, and efficiency. A healthy ratio analysis supports the valuation model by providing a clear and compelling financial narrative. For example, the return on equity ratio reveals the company’s ability to generate profits relative to its shareholder investments. Ratio analysis is a crucial component of a thorough valuation, which provides useful insights into business performance and identifies strengths and weaknesses.

Integrating Accounting with Valuation Models for Accurate Projections

Integrating Accounting Data with Valuation Models:

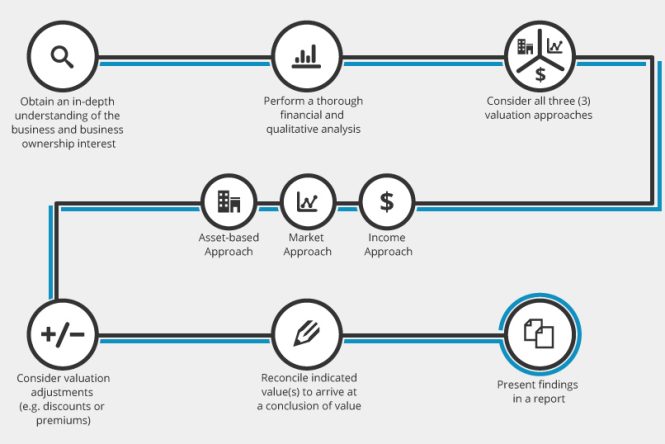

For accurate business valuation, you must integrate accounting data with appropriate valuation models. The chosen model should reflect the specific characteristics of the business. For a publicly traded company, discounted cash flow (DCF) analysis is commonly used. A DCF valuation will require meticulous analysis of the company’s historical financial performance, future projections, and industry trends to produce accurate projections.

Using Accounting Information in DCF Valuation Model:

The DCF valuation model relies heavily on reliable historical and projected accounting data. Accurate financial projections are critical for an accurate valuation outcome. It’s crucial to consider factors like the discount rate, projected cash flows, and terminal value. Consider a restaurant aiming to secure funding; the DCF model analyzes historical revenue and operational costs to predict future cash flows. Accounting accuracy is paramount to this success. Historical data and trends are crucial inputs for any valuation model and must be derived from sound financial records and reports.

Case Studies and Real-World Examples

Successful Application of Accounting Strategies:

Numerous companies have successfully leveraged accounting principles to boost their business valuation. A case study of a software firm that meticulously tracked key metrics like revenue per user and customer lifetime value successfully showcased its sustainable growth potential to investors. The consistency in reporting, coupled with clear and transparent financial practices, increased investor confidence and translated into a higher valuation. This demonstrates the impact of strong accounting practices on business valuations.

Lessons Learned from Valuation Mistakes:

Conversely, companies failing to prioritize consistent accounting procedures have faced challenges in valuations. One case involved a manufacturing company with inaccurate inventory accounting and inconsistent reporting of production costs. This lack of accurate accounting led to an underestimation of the company’s value, resulting in missed funding opportunities.

Implementing Accounting Strategies for Valuation Refinement

Implementing Accounting Best Practices for Valuation Refinement:

Implementing accounting best practices, including proper documentation and internal controls, elevates a business’s valuation. Accurate financial reporting attracts investors and lenders, increasing the valuation potential. This process includes ensuring consistent record-keeping, accurately categorizing transactions, and adopting reliable accounting procedures, such as GAAP. These meticulous practices enhance the credibility and transparency of the company, ultimately impacting the valuation outcome positively.

Refining Your Valuation Strategy Through Financial Analysis:

Refine your valuation strategy through comprehensive financial analysis. Utilizing appropriate valuation models and integrating financial data allows you to build a compelling narrative about the business’s value and future potential. For example, consider using a discounted cash flow (DCF) analysis—by properly applying financial data to a valuation model, the results will be more robust and reliable. By implementing this process, the business valuation plan becomes more credible and detailed.

Frequently Asked Questions

What is the importance of accurate accounting for a business valuation plan?

Accurate accounting provides a robust foundation for a comprehensive valuation plan. It ensures financial statements reflect the true financial position and performance of the business, leading to a more accurate valuation. Without accurate accounting, the valuation is likely flawed and can lead to incorrect investment decisions. Detailed accounting fosters trust with investors and strengthens the business’s credibility.

How can accounting strategies improve the valuation of a small business?

Accounting strategies for small businesses focus on streamlining operations, ensuring accurate record-keeping, and highlighting key performance indicators. This approach enhances the business’s appeal to investors and lenders, leading to higher valuations. Implementing efficient accounting systems enables small businesses to project future performance reliably, crucial for securing funding and attracting investors. Thorough financial records are a cornerstone of a strong business valuation plan.

In conclusion, strategically using accounting to enhance your business valuation plan can yield significant benefits. By meticulously analyzing financial statements, adopting proper accounting procedures, and focusing on key financial metrics, entrepreneurs can significantly boost their valuation. Implementing these strategies requires a deep understanding of accounting principles, combined with a forward-thinking approach. This article has served as your guide for building a robust valuation framework. Next, research reputable business valuation consultants to further refine your strategy or consider pursuing financial planning courses to solidify your understanding. The key takeaways are to prioritize accuracy, consistency, and a thorough understanding of your company’s financial performance. Remember, a well-defined accounting framework is the cornerstone of a successful business valuation plan.