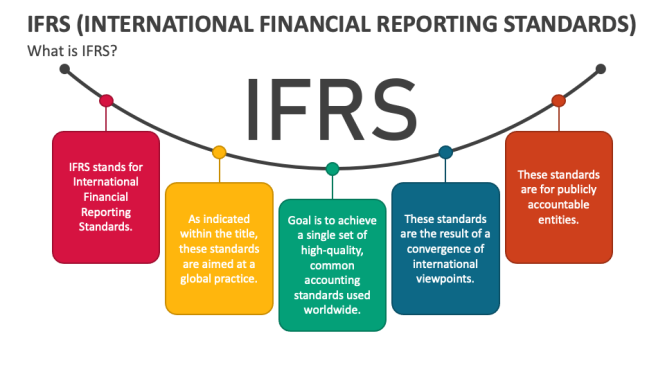

International Financial Reporting Standards (IFRS) have become a global benchmark for financial reporting, demanding careful consideration from companies operating in various jurisdictions. Understanding and applying these standards effectively is crucial for accurate financial reporting, facilitating transparency, and boosting investor confidence. This article will delve into the key aspects of IFRS, highlighting its complexities and offering valuable strategies for navigating them.

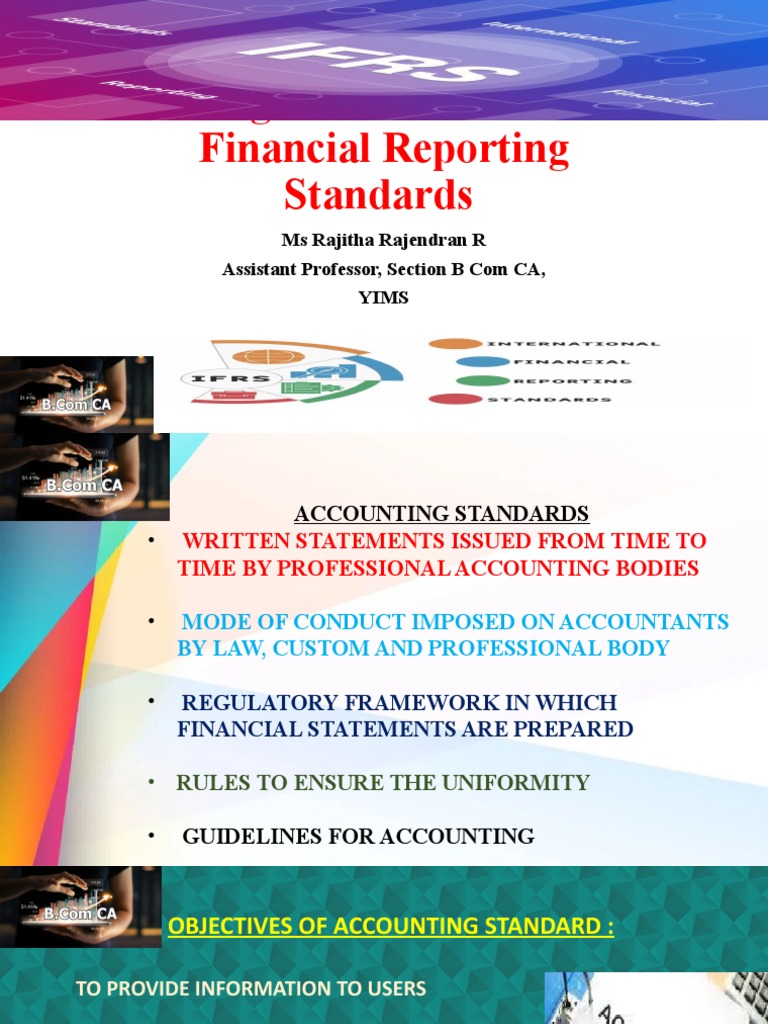

IFRS, a set of accounting standards, provides a common language for financial reporting across countries. Its adoption worldwide ensures comparability of financial statements, fostering transparency and facilitating cross-border investments. However, the complexity of IFRS principles can be daunting for many organizations.

One key challenge lies in the conceptual framework underpinning IFRS. A thorough understanding of the underlying principles, such as prudence, substance over form, and going concern, is crucial for consistent application. Without this foundational knowledge, companies risk misinterpreting the standards and generating inaccurate reports.

Moreover, IFRS standards are often nuanced and require careful interpretation. The presence of multiple interpretations and application guidance notes necessitates a deep understanding of the context in which these standards should be applied. This interpretation is key to avoiding accounting irregularities or misleading financial presentations.

Staying current with the amendments and updates to IFRS is equally essential. These changes often clarify ambiguities or address emerging issues, affecting how specific transactions should be reported. Continuous learning and professional development become critical for accountants and financial professionals.

A proactive approach to IFRS implementation is highly recommended. Companies should establish dedicated teams to interpret and apply the standards consistently. This involves training staff on the latest IFRS updates and the critical use of accounting software and tools.

Professional guidance can also greatly assist in navigating the intricacies of IFRS. Consulting with experienced accountants and financial experts can provide valuable insights and support in interpreting the standards and ensuring appropriate application.

This can involve conducting thorough research and utilizing various resources like IFRS interpretations, pronouncements, and practical examples. Organizations should use available educational materials and workshops to enhance their understanding and proficiency with IFRS concepts.

Ultimately, mastering IFRS involves a blend of knowledge, diligence, and continuous engagement. Understanding the standards, staying informed about updates, and leveraging available resources are all essential components for successful implementation.

Ultimately, the practical application of IFRS requires a commitment to continuous improvement and a willingness to seek expert guidance whenever needed. This proactive approach is essential for effective financial reporting and maintaining a robust global accounting framework.

Navigating the intricacies of International Financial Reporting Standards (IFRS) requires a meticulous understanding of its principles and practical application. By embracing continuous learning, staying updated with the latest amendments, and seeking expert guidance, companies can effectively manage the complexities of IFRS and ensure accurate and reliable financial reporting. This ultimately contributes to greater transparency and investor confidence in the global marketplace.