Strategies for Managing Financial Aspects of E Commerce Businesses Plan are paramount for the success and sustainability of any online business. A well-structured financial plan is not just an accounting exercise; it’s the roadmap for achieving your e-commerce goals. Many e-commerce businesses struggle with managing their finances, leading to poor cash flow, missed opportunities, and ultimately, failure. This article will delve into proven strategies to effectively manage the financial aspects of your e-commerce venture. We’ll cover key aspects like budgeting, cash flow forecasting, and inventory control, providing practical examples and actionable steps you can implement immediately. This article is structured to provide a comprehensive overview, starting with a foundational understanding of e-commerce finances and then progressing to practical implementation strategies.

Understanding E-commerce Financial Fundamentals

Defining the Financial Landscape

Successful e-commerce ventures require a firm grasp of fundamental financial concepts. Understanding key financial statements like the income statement, balance sheet, and cash flow statement is crucial. These statements provide insights into your business’s profitability, assets, liabilities, and cash flow. Proper analysis allows for informed decision-making and proactive financial management. For example, a detailed income statement can reveal areas of high spending or underperforming product lines, guiding strategic adjustments.

Key Financial Metrics for E-commerce

Several key performance indicators (KPIs) provide a clear picture of your e-commerce business’s financial health. Revenue, expenses, profit margins, cost of goods sold (COGS), and customer acquisition cost (CAC) are vital metrics to track. Monitoring these KPIs helps identify trends, measure progress, and make data-driven decisions. For instance, tracking CAC helps optimize marketing campaigns and ensure profitability.

Setting Realistic Financial Goals

Realistic financial goals are crucial for guiding financial strategies. Establish clear, measurable, achievable, relevant, and time-bound (SMART) goals. Examples of such goals could include increasing revenue by 20% in the next quarter or reducing customer acquisition costs by 15%. These goals provide a framework for the financial strategies outlined in the following sections.

Budgeting for E-commerce Success

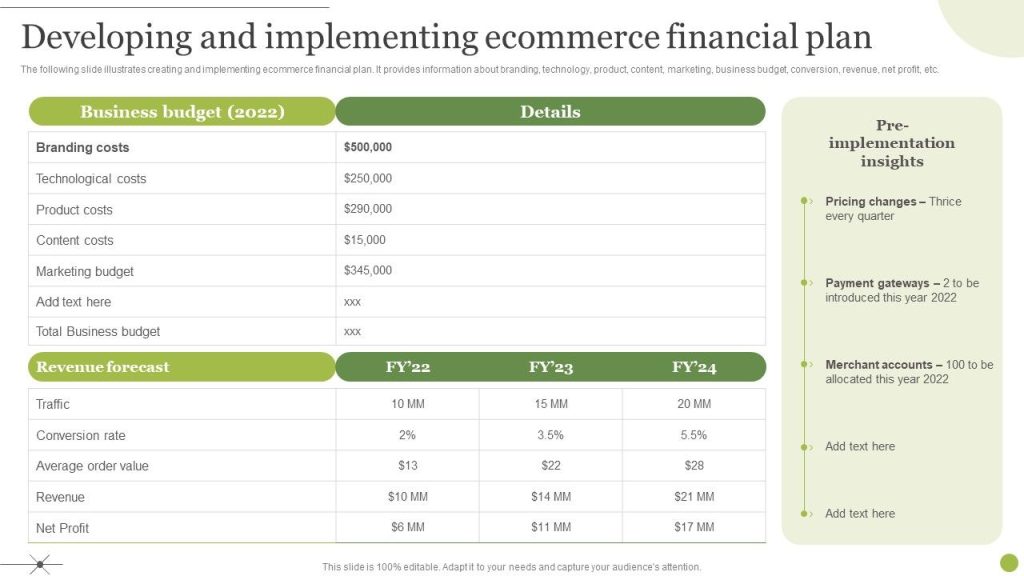

Developing a Comprehensive Budget

A detailed budget is the cornerstone of effective financial management. It outlines projected revenue, expenses, and profit for a specific period, typically a quarter or a year. A well-structured budget ensures you stay on track, anticipate potential issues, and allocate resources efficiently. For example, a comprehensive budget helps with accurate expense tracking and forecasting, guiding resource allocation for marketing and inventory.

Categorizing Expenses and Revenue

Categorizing expenses and revenue streams provides a clear picture of your business’s financial performance. This allows for detailed analysis of spending patterns and revenue sources. For instance, separating marketing expenses by channel (e.g., social media, search engine marketing) provides valuable data to optimize marketing ROI.

Implementing a Flexible Budget

A flexible budget acknowledges the unpredictable nature of business and adapts to changing circumstances. It accounts for fluctuations in sales, expenses, and market conditions. A flexible budget is critical for adapting to changing market trends or economic downturns, ensuring the business maintains financial stability during challenging periods.

Cash Flow Management Strategies

Forecasting and Managing Cash Flow

Accurate cash flow forecasting is crucial for e-commerce businesses. Forecasting anticipates future cash inflows and outflows, enabling proactive measures to avoid cash flow shortages. Consider using historical data and sales trends to create an accurate forecast. For instance, a well-managed cash flow forecast helps with timely payment of invoices, preventing late payment fees and maintaining positive supplier relationships.

Optimizing Inventory Management and Controlling Expenses

Efficient inventory management directly impacts cash flow. Implementing inventory control systems helps maintain optimal stock levels, avoid overstocking, and reduce carrying costs. Controlling expenses is equally vital. Strategies such as negotiating better deals with suppliers, optimizing fulfillment methods, and reducing operational costs can significantly improve cash flow. For example, utilizing inventory management software can help to predict demand and ensure you have the right products in stock at the right time.

Implementing Financial Tools and Software

Using financial tools and software, such as accounting software and invoicing platforms, simplifies tracking expenses, calculating sales tax, and generating reports. Leveraging these technologies improves efficiency, enhances data accuracy, and streamlines the financial processes within your e-commerce business.

Pricing Strategies for Profitability

Analyzing Pricing Models and Competitive Landscape

Conducting thorough research to understand the competitive pricing landscape is crucial. Analyze the pricing strategies of competitors and identify opportunities to differentiate your product offerings while maintaining profitability. For instance, understanding pricing trends in your niche can guide your product pricing strategy and inform potential discounts or promotions.

Determining the Right Pricing Model

Several pricing models can be applied in e-commerce, including cost-plus pricing, value-based pricing, and competitive pricing. Choosing the right model is vital for optimizing profitability while attracting the target market. For example, value-based pricing emphasizes the perceived value of the product rather than the direct cost.

Testing and Adjusting Pricing Strategies

Continuous monitoring and adjustments are essential for maintaining profitability and competitiveness. Test different pricing strategies, analyze sales data, and adapt your approach based on customer response and market trends. For example, using A/B testing with different pricing tiers can highlight the most effective approach for maximizing profits.

Strategic Budgeting and Financial Planning

Creating a Realistic Financial Forecast

Predicting future revenue, expenses, and cash flow is essential to effectively manage your financial resources. Establish realistic financial projections for the next quarter or year and consider potential market fluctuations or seasonal changes. For example, consider seasonal demand fluctuations when forecasting e-commerce revenue.

Implementing Recurring Revenue Streams

Diversifying revenue streams can enhance financial stability and resilience. Exploring recurring revenue models, such as subscription services or membership programs, can provide predictable revenue streams. This approach is especially useful in sustaining operations during economic downturns and minimizing the effect of unexpected sales fluctuations.

Monitoring and Adjusting Financial Performance

Regular monitoring of key financial metrics is critical. Track progress towards financial goals and make adjustments as needed. Implementing regular financial reviews and analysis allows for proactive measures to address issues before they escalate, ensuring the business remains financially stable and profitable.

Appendix: Resources and References

Frequently Asked Questions

How can I create a financial plan for my e-commerce business?

Developing a financial plan for your e-commerce business requires careful consideration of various factors. First, determine your business goals and objectives. Next, create a detailed budget encompassing all projected revenue and expenses. Forecast your cash flow and identify potential challenges. Include contingency plans for unexpected events. Finally, regularly review and adjust your financial plan based on actual performance and market trends.

What are some common financial pitfalls in e-commerce businesses?

Common financial pitfalls in e-commerce businesses include inadequate budgeting, poor cash flow management, and ineffective pricing strategies. Failure to track expenses diligently, ignoring the importance of accurate cash flow forecasts, and adopting uncompetitive pricing models can lead to financial instability. Additionally, poor inventory management and unpredictable market conditions are also crucial areas to address.

In conclusion, effectively managing the financial aspects of your e-commerce business is crucial for its success and sustainability. Careful planning, strategic budgeting, and consistent monitoring of key financial metrics are vital for long-term growth. By understanding and implementing these strategies, e-commerce entrepreneurs can navigate the financial complexities and build a prosperous online venture. To receive personalized advice and support, schedule a consultation with our financial experts. Visit [link to website] to learn more.