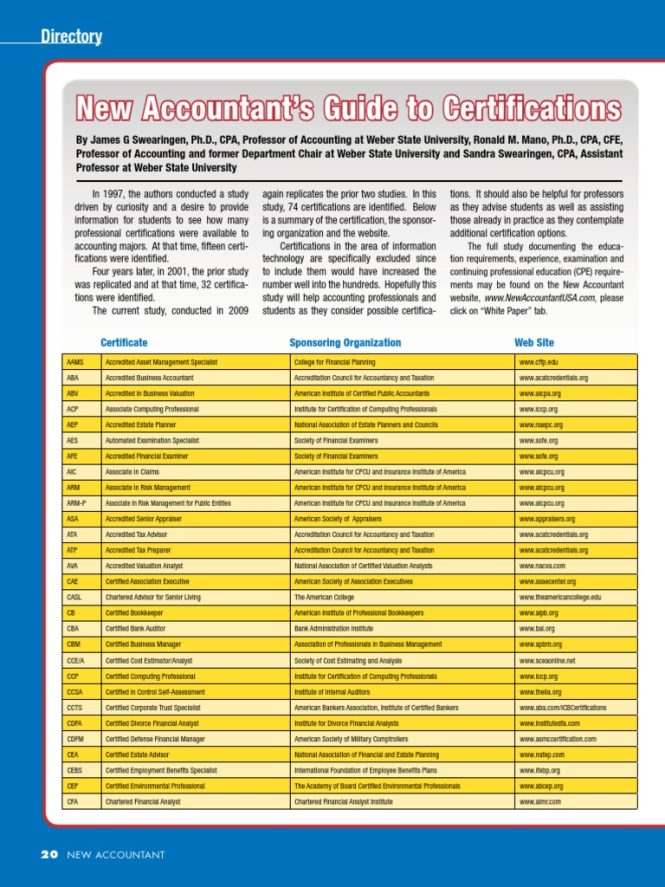

The realm of accounting boasts a diverse array of certifications, each designed to validate specific skills and knowledge. Understanding the different types of accounting certifications is essential for individuals seeking to advance their careers in this dynamic field.

Choosing the right accounting certification can be a pivotal step toward career advancement. Various certifications cater to different specializations within the accounting field, from auditing and taxation to financial and managerial accounting.

One prominent certification is the Certified Public Accountant (CPA) designation. CPAs are highly sought-after professionals known for their expertise in auditing, taxation, and financial accounting. Earning this certification typically involves passing rigorous exams and meeting specific experience requirements.

Another significant certification is the Certified Management Accountant (CMA). CMAs focus on the managerial aspects of accounting, including financial planning and analysis, cost accounting, and performance management. Their expertise is invaluable in businesses needing effective financial strategies.

For those interested in the intricacies of financial reporting, the Chartered Financial Analyst (CFA) charter stands out. CFAs possess a profound understanding of investment strategies, portfolio management, and financial analysis. They are frequently found in the investment and financial services industries.

Beyond these prominent certifications, various other certifications cater to specific niches within the accounting realm. These include certifications for tax professionals, forensic accountants, and government accountants.

The path to earning an accounting certification typically involves a combination of educational requirements, passing exams, and gaining practical experience. Each certification body sets its own specific standards and expectations, making it essential to thoroughly research the certification before committing to the process.

Exam preparation is a critical aspect of earning any accounting certification. Dedicated study, practice questions, and review materials are essential for success in the demanding examinations. Consider enrolling in preparatory courses to gain a comprehensive understanding of the material.

The benefits of earning an accounting certification extend beyond professional recognition. A certification can enhance career prospects, open up new opportunities, and lead to higher earning potential. Additionally, certifications often indicate a commitment to professional development and ethical conduct.

Considering the variety of accounting certifications available, the best choice hinges on personal career aspirations. A deep understanding of the different specializations and the requirements for each certification is key. Explore the opportunities each certification presents to align with your career goals and objectives. Be aware that specific industry requirements can vary, affecting the relevance of certain certifications. So research thoroughly to find the best fit for your particular ambitions and your industry’s demands in order to reach your goals efficiently and strategically. A well-researched approach will lead to better career prospects and increased compensation potential. Each certification opens new avenues to explore, so don’t hesitate to research the options available to you so you are completely prepared to succeed in the accounting field! This will elevate your professional profile and set you apart from other job candidates and also help your career goals reach a higher point of professionalism, experience and success. Consider whether you enjoy the technical aspects of accounting or the managerial aspects, this is key in helping you make the right choice for your career! This is vital in order to get started on a solid accounting career foundation. Don’t just choose randomly- be strategically informed and in-depth about which path to follow in your career advancement in accounting to achieve success and recognition in this field. Remember that networking with accounting professionals and staying updated with industry trends are important aspects of success in any accounting career path. The diverse opportunities in accounting provide a dynamic landscape for career growth and professional advancement. Networking and professional development are important for career growth. Research accounting certification requirements thoroughly and strategically make sure you’re fully prepared in order to succeed and get the best out of your accounting career and the relevant professional accounting certifications you wish to pursue. By gaining and understanding these valuable accounting certifications, your career path will greatly improve, expand, and set you apart from others and help you gain more success in your future. Always be prepared to take the next step and explore new opportunities in the accounting field!

In conclusion, understanding the diverse range of accounting certifications is crucial for professionals looking to advance their careers in this field. Each certification offers specific benefits and requirements, and the best choice depends on individual career goals and aspirations. By researching and comparing various certifications, aspiring accountants can make informed decisions and chart a course for success within the dynamic world of accounting.