The impact of changing economic policies on accounting practices is a complex and ever-evolving issue. Governments worldwide constantly adjust their economic strategies, influencing how businesses operate and ultimately, how their financial records are kept. Accounting practices, therefore, are continuously adapting to reflect these policy shifts. This article delves into the significant ways economic policies influence accounting, examining the specific challenges and opportunities they present. We’ll cover the role of international accounting standards, the impact of tax policies, and how companies can adjust their strategies to maintain compliance and financial stability. The structure of this analysis will first define accounting practices and their importance within a global economy, then discuss the influence of changing economic regulations, and finally, offer practical advice for businesses seeking to maintain compliance and financial stability in a constantly evolving landscape.

Defining Accounting Practices and Their Global Significance

Understanding Fundamental Accounting Concepts

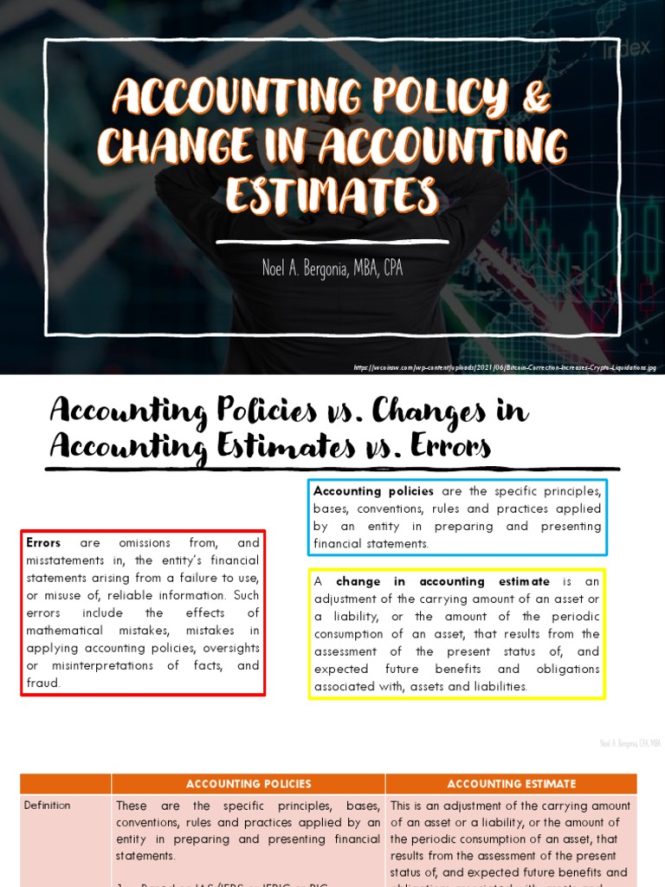

Accounting practices are the systematic methods and procedures used by businesses to record, analyze, and report their financial transactions. Accurate financial reporting is fundamental to a well-functioning global economy. This reporting provides investors, creditors, and stakeholders with critical insights into a company’s performance, health, and future prospects. International accounting standards (IAS) play a crucial role in harmonizing practices across different countries, fostering transparency and comparability. The consistent application of accounting standards enhances the reliability and usability of financial information globally.

Impact of Global Economic Policies on Accounting

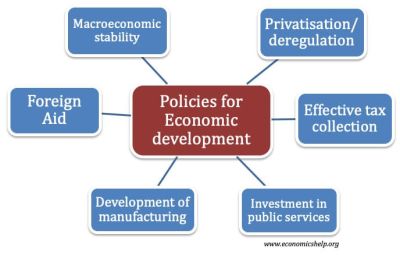

Global economic policies, from monetary policies set by central banks to fiscal policies enacted by governments, directly affect the accounting decisions companies make. These policies directly influence factors like interest rates, inflation, exchange rates, and tax laws. These shifts in economic conditions significantly affect the way companies account for their income, expenses, assets, and liabilities.

Navigating International Accounting Standards (IAS)

The Importance of Harmonization

International accounting standards, such as those set by the International Accounting Standards Board (IASB), play a key role in standardizing financial reporting practices globally. This harmonization fosters transparency and comparability of financial information across different countries, enabling investors and other stakeholders to make informed decisions. Without standardization, investors would find it far more challenging to assess the financial health of companies operating in various countries.

Challenges and Adaptations

However, adapting to these IAS standards can pose significant challenges for companies. Differences in accounting principles and practices across jurisdictions require businesses to adjust their methods to ensure compliance. This process of adaptation can sometimes be complex and costly, requiring significant resources for training and implementation. A key example is when a country implements new regulations or policies that drastically alter the way businesses operate within its borders. Accounting standards must often adapt to these new policies in order to continue the consistent and transparent accounting information.

The Impact of Tax Policies

How Tax Policies Affect Accounting Practices

Tax policies are a significant driver of accounting practices. Changes in corporate tax rates, deductions, or credits can significantly influence a company’s financial statements. Businesses need to account for the current and potential future impact of tax policies on their financial position and future operations. A clear example of this is the differing tax policies that each country has to deal with, which requires businesses to implement the standards that are in compliance with those policies.

Case Studies: Adapting to Tax Reforms

Several case studies highlight the impact of tax reforms on accounting practices. For instance, the implementation of a new tax credit for renewable energy investments would necessitate accounting adjustments to recognize the related tax benefits. Conversely, a change in the corporate tax rate might lead to a reassessment of the company’s taxable income and deferred tax liabilities. Accurate accounting records are absolutely essential for compliance in these cases.

Economic Fluctuations and their Accounting Implications

The Role of Inflation

Economic fluctuations, such as inflation, significantly impact accounting practices. Inflation affects the value of assets and liabilities, necessitating adjustments in financial statements. Accounting for inflation typically involves using techniques such as historical cost accounting, current cost accounting, or inflation-adjusted accounting. The choice of method directly influences reported financial performance, therefore, careful consideration is essential.

Handling Economic Downturns

Economic downturns pose accounting challenges in different ways. For example, asset impairment losses are often recognized during a recession as asset values decrease. Accurate financial reporting is crucial to signal the company’s standing during an economic downturn. This is critical for investors and stakeholders.

Business Strategies for Adapting to Changing Economic Policies

Proactive Compliance Strategies

Businesses need to adopt a proactive approach to comply with evolving economic policies. Staying informed about potential changes in regulations and tax laws is essential. This proactive approach helps businesses adapt effectively to changes and maintain compliance. This can include regularly reviewing financial reports and seeking professional advice from financial experts.

The Importance of Professional Consultation

Consulting with qualified accounting professionals who are knowledgeable about the latest regulatory changes is highly recommended. These experts can guide companies in developing and implementing appropriate accounting strategies that align with the economic realities and the needs of their specific industry.

json

[

{

"question": "What are the key steps businesses can take to ensure their accounting practices adapt to shifting economic policies?",

"answer": "Businesses should develop a proactive strategy for staying informed about potential changes in economic policies and tax laws. This could involve regularly reviewing relevant regulations, attending industry conferences, or consulting with experts. Adapting accounting practices promptly to meet evolving standards is also critical for compliance and maintaining investor trust."

},

{

"question": "How does the impact of global economic fluctuations affect accounting processes?",

"answer": "Global economic fluctuations such as inflation and recessions can significantly influence accounting processes. Inflation leads to adjustments in the valuation of assets and liabilities. Recessions often bring about asset impairment charges as asset values decline. Businesses must incorporate these economic impacts into their financial reporting to maintain accurate and reliable financial statements."

}

]

In conclusion, the impact of shifting economic policies on accounting practices is profound and multifaceted. Understanding these changes is crucial for businesses to adapt and thrive in today’s dynamic environment. By staying informed about evolving regulations and adjusting their accounting methodologies accordingly, companies can ensure accurate financial reporting and maintain a competitive edge. This article has explored several key areas of impact and provided practical insights. For a deeper dive into specific industry applications or for personalized guidance, consider consulting with a qualified accounting professional.