Strategies for Managing Risk and Compliance in international business operations are paramount for sustained success in today’s globalized economy. Navigating diverse legal frameworks, cultural nuances, and varying ethical standards is no small feat. This article will explore crucial strategies to proactively manage risk and ensure compliance throughout your international business operations. We’ll examine essential frameworks, best practices, and real-world examples. We will analyze challenges specific to international business compliance, provide practical solutions, and showcase a strategic approach to risk mitigation. This comprehensive guide will cover elements such as due diligence, anti-corruption measures, compliance programs, and risk assessment procedures. The structure of the article will be as follows: first, we’ll examine the importance of risk management. Next, we’ll delve into the intricacies of compliance programs and their design. Then, we’ll explore specific strategies for managing compliance across different regions and countries. Finally, we’ll offer practical takeaways and recommendations for implementing effective strategies.

The Importance of Proactive Risk Management

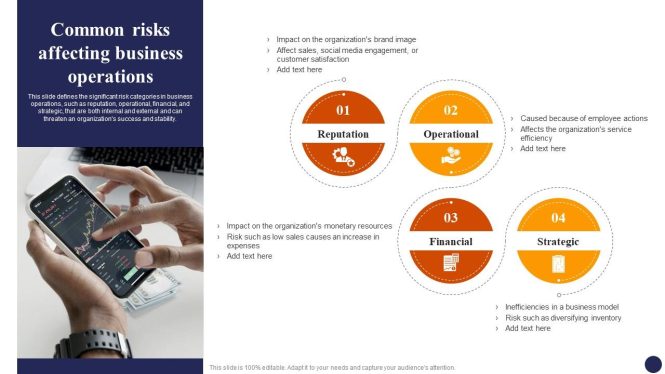

International business operations inherently present complex challenges related to navigating diverse legal landscapes and cultural considerations. A comprehensive approach to risk management is essential to mitigating potential legal, financial, and reputational harm. Failure to address these challenges proactively can lead to severe penalties, including hefty fines, legal battles, and damage to a company’s reputation. Companies operating internationally must recognize the inherent risks and develop robust strategies to effectively manage and mitigate them. For instance, a failure to comply with local labor laws in a foreign market could lead to significant legal repercussions, while ethical lapses in business conduct can severely damage a company’s reputation and brand. Therefore, an effective risk management strategy is critical for success in the global marketplace.

Establishing a Robust Risk Management Framework

Proactive identification and assessment of potential risks are paramount in the context of international business. This involves a deep understanding of local regulations, market conditions, and political landscapes. A robust risk management framework should include processes for identifying and assessing potential risks, establishing mitigation strategies, and developing contingency plans. It should also encompass a clear communication strategy to ensure transparency and accountability within the organization. This process should be iterative and adaptive, recognizing that global business environments are constantly evolving.

Best Practices for Risk Assessment

Understanding the nuances of risk assessment in international settings requires an understanding of political and economic risk, including fluctuating exchange rates, regulatory changes, and geopolitical instability. Businesses must adapt risk assessment strategies in such a way that can address specific circumstances in each country and region. In addition to traditional risk factors, companies must consider risks relating to cultural sensitivity, legal and regulatory requirements, and potential reputational damage. A company’s risk profile should evolve as it enters new markets, and it needs to be vigilant about emerging risks related to supply chains, intellectual property theft, and changing regulations in global business.

Building and Maintaining Effective Compliance Programs

Building and maintaining robust compliance programs is an integral part of navigating the global landscape successfully. Effective compliance programs go beyond mere adherence to laws and regulations, fostering an ethical and legal culture within the organization. This culture emphasizes transparency and accountability. A key element of building these programs is having a dedicated compliance officer or team who can manage compliance requirements and enforce them effectively. These professionals are vital to understanding how new regulations affect operations, and to develop effective mitigation strategies.

Implementing Due Diligence Procedures

Thorough due diligence procedures are essential for mitigating legal and reputational risks. Companies should conduct rigorous investigations into potential partners, suppliers, and distributors to ensure they are reputable and compliant. Consider the potential legal ramifications of operating in regions with high corruption or weak regulatory frameworks. Due diligence measures may include background checks, financial audits, and regulatory compliance reviews of potential business partners. Understanding and implementing due diligence is critical to avoiding legal trouble and reputational damage.

Anti-Corruption Compliance

Anti-corruption measures are paramount in international business operations. Companies must implement strong policies and procedures to prevent bribery and corruption. Establish clear guidelines and training programs to educate employees on anti-corruption practices, including understanding the nuances of different regions’ ethical standards, and how such standards might differ from the organization’s home country.

Navigating Compliance in Different Regions and Jurisdictions

International business operations necessitate a tailored approach to risk and compliance, as regulations and standards differ significantly from country to country. A thorough understanding of specific requirements for every target market is necessary to ensure compliance with laws, tariffs, and trade agreements.

Compliance with Local Regulations

Understanding and complying with local regulations is a fundamental step. Ensure awareness of diverse legal and regulatory frameworks in various regions. Conduct thorough research on relevant laws, trade agreements, environmental regulations, and local labor laws. Adapting your compliance strategy and policies to the specifics of each region is key. The complexities of international trade compliance frequently involve trade agreements between nations.

Cultural Sensitivity and Ethical Considerations

Cultural considerations are essential when managing risk and compliance in international operations. It is important to recognize that cultural norms and values vary greatly across the globe. Recognizing these variations is essential for upholding ethical standards and preventing misunderstandings. For instance, certain business practices deemed acceptable in one country might be viewed as unethical or even illegal in another.

Implementing and Monitoring Compliance Efforts

Compliance efforts require ongoing attention and continuous improvement. Having a robust system for monitoring and auditing is critical to ensure ongoing compliance.

Establishing Clear Communication Channels

Transparency and open communication channels are paramount for ensuring everyone understands and adheres to the company’s compliance policies. A streamlined communication system for both internal and external stakeholders will be key to success in managing international business operations.

Ongoing Training and Education

Continuous training and education programs are critical. This ensures employees at all levels understand the complexities of international business operations and the importance of compliance. Regular training reinforces compliance policies in the workplace.

Developing Contingency Plans for Risk Management

Developing contingency plans is a critical aspect of proactive risk management. Anticipating potential crises and preparing contingency plans helps ensure minimal disruption and a quick return to business operations when issues arise.

Risk Response Procedures

Establish clear procedures for handling potential crises and violations. Proactive development of such procedures reduces the impact of unexpected events in international business operations.

Regular Review and Update

Contingency plans should be reviewed and updated regularly to account for evolving global environments and new regulations. International business risk assessments need to be conducted regularly, given the rapid evolution of international markets.

In conclusion, effectively managing risk and compliance in international business operations is crucial for sustained success and growth. By implementing a robust framework, businesses can mitigate potential legal and reputational harm, fostering trust with stakeholders and ensuring adherence to global regulations. A commitment to continuous improvement and proactive risk assessment is essential in navigating the complex landscape of international commerce. To further enhance your organization’s risk management strategies, consider partnering with specialized compliance consultancies for guidance and support. This strategic approach can prove invaluable in maintaining successful and ethical international business operations.