Strong supplier relationships are a cornerstone of successful businesses. Effective account payable (AP) management is vital for maintaining those relationships and ensuring smooth financial operations. This comprehensive guide delves into strategies for optimizing your accounts payable process and cultivating positive, mutually beneficial supplier partnerships.

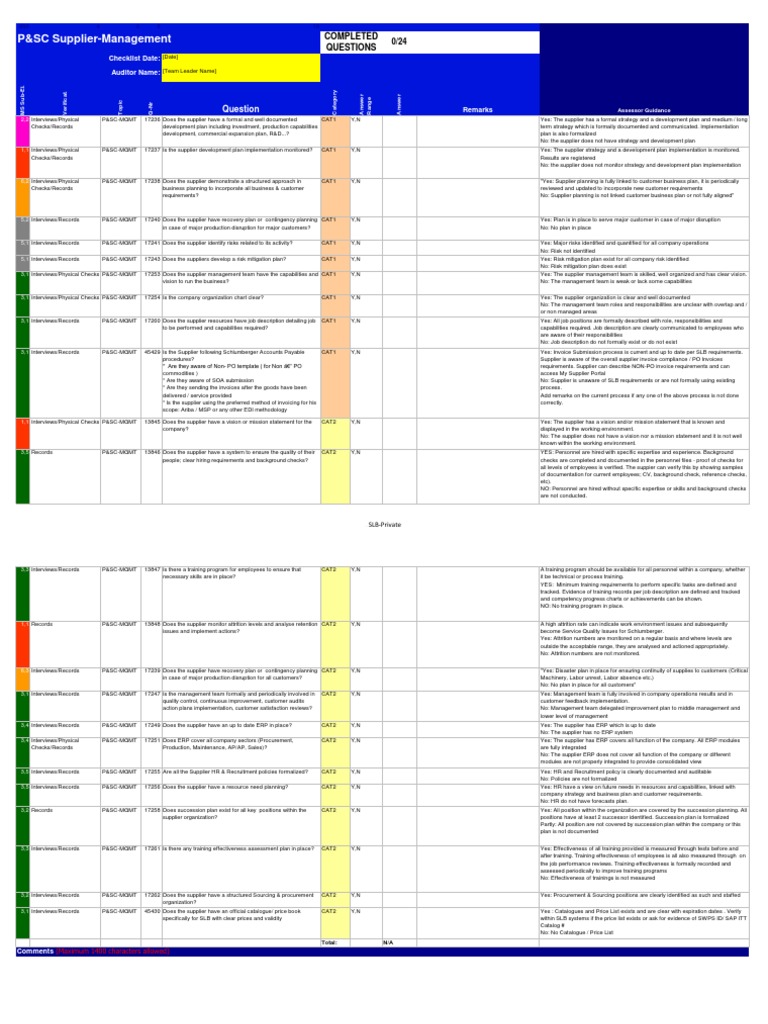

A well-structured accounts payable process is fundamental to a healthy financial system. This involves meticulous invoice processing, accurate record-keeping, and adherence to agreed-upon payment terms.

Prompt and accurate payments are crucial to maintaining good relationships with suppliers. Late payments can damage trust and create disruptions in the supply chain. Establishing clear payment terms and timelines with suppliers from the start is essential.

Implementing a streamlined invoice processing system is key to optimizing your accounts payable workflow. Utilize technologies like automated invoice processing software to expedite the process and minimize errors. Automated systems can also help you track invoices efficiently and ensure timely payments.

Negotiating favorable payment terms with key suppliers can significantly impact your cash flow management. Understanding your financial position and the supplier’s needs allows for strategic negotiations. Longer payment terms, if appropriate, can free up cash for other critical operations.

Maintaining open communication with suppliers is paramount to building strong relationships. Establish clear communication channels for inquiries, feedback, and addressing any issues promptly.

A dedicated accounts payable team, if feasible, can effectively handle the volume of invoices and payments, ensuring accuracy and efficiency. Furthermore, proper accounting practices, including meticulous record-keeping, are vital to maintain transparency and accountability within the accounts payable department.

Using a supplier portal or a dedicated platform for communication and information sharing can greatly improve the overall process. This digital connection streamlines invoice submission, payment tracking, and issue resolution.

Leveraging technology for accounts payable automation can reduce manual data entry and processing errors. Moreover, automation ensures a more organized system for managing supplier relationships and financial accounting.

Regularly reviewing and evaluating your supplier relationships is critical for identifying areas for improvement and strengthening strategic partnerships. Consider factors like reliability, service quality, and delivery times when assessing your suppliers. This evaluation provides insights to optimize your entire process for maximum productivity and profits in the long run, and also aids in Accounting functions too.

In conclusion, effectively managing accounts payable and optimizing supplier relationships is crucial for any business’s financial health and operational efficiency. By implementing these strategies, companies can streamline their payment processes, foster strong supplier partnerships, and ultimately achieve greater profitability and resilience.