Financial aspects of career planning are fundamental to building a successful and fulfilling career. A strong understanding of your financial resources and goals is essential for navigating the complexities of modern professional life. Financial planning encompasses the meticulous process of assessing your current financial situation, defining future financial goals, and devising strategies to achieve these objectives, ensuring a stable and secure financial foundation for your career trajectory. Many professionals neglect these crucial aspects, leading to financial anxieties and hindered career advancement. This comprehensive guide will address this issue by providing a detailed framework for crafting a personalized budgeting and long-term analysis plan, enabling you to take control of your finances and achieve your career aspirations.

Budgeting for Career Advancement

Defining Your Financial Needs

Understanding your current financial situation is the cornerstone of effective budgeting. A thorough evaluation of income, expenses, and debts is crucial for formulating a sustainable plan. Detailed budgeting analysis helps you determine whether you are living within your means or if adjustments are necessary. Analyze your income sources, meticulously track your expenses, categorize them, and identify areas where you can cut costs without compromising your lifestyle or needs. The aim is not just to save money but also to allocate resources strategically. By understanding what you earn and spend, you can identify financial gaps that may be hindering your career ambitions.

Establishing a Sustainable Budget

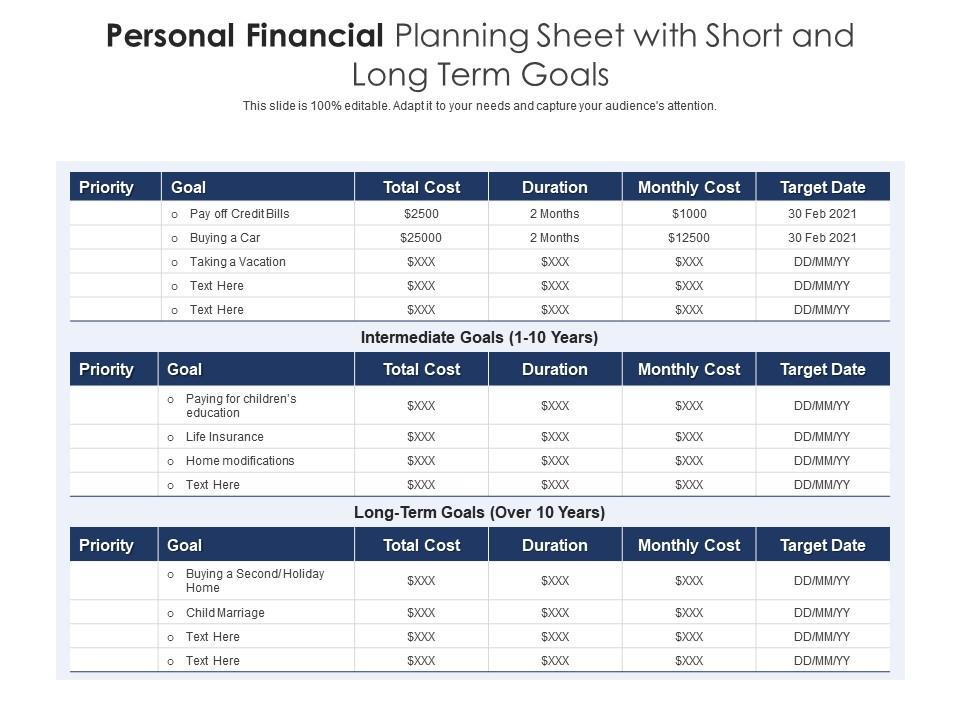

Once your current financial standing is clear, crafting a realistic and sustainable budget is paramount. This involves creating separate categories for essential expenses like housing, transportation, food, and utilities. This ensures that your budget is comprehensive in its coverage. Allocate funds for unexpected costs or emergencies to mitigate financial shocks. Allocate money for saving and investment based on your desired financial growth trajectory for career advancement and long-term goals. Utilize budgeting apps or spreadsheets to track your progress and make adjustments to your budget as needed. One effective strategy is to prioritize needs over wants, allocating funds for necessities and saving diligently. This may also require evaluating and adjusting your lifestyle or negotiating better deals on services.

Example: Student Debt Reduction

A recent graduate with substantial student loans might prioritize debt repayment over other spending. They might need to find ways to reduce expenses and/or increase their income, thereby dedicating a higher percentage of their budget towards loan repayment. This example demonstrates how a proactive financial approach can improve financial stability.

Long-Term Financial Analysis

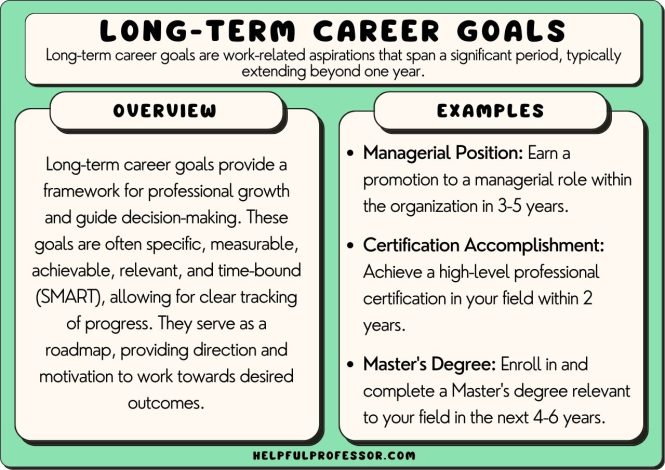

Setting Realistic Goals

Long-term financial analysis extends beyond short-term budgeting; it focuses on your financial trajectory over several years. This involves establishing concrete financial objectives for your career and personal goals. Consider your career aspirations and the financial resources needed to achieve them. Long-term goals such as saving for a home, starting a family, or funding higher education require meticulous planning and careful savings strategies. Consider how your career path and financial goals align, ensuring consistency and harmony between personal aspirations and career objectives.

Investment Strategies

Investment strategies play a critical role in long-term financial planning, as consistent investment habits help build wealth. Assess your risk tolerance, which significantly impacts your investment decisions. Evaluate various investment options, such as stocks, bonds, mutual funds, or real estate, considering their potential returns, risks, and the investment timelines associated with them. Seeking professional financial advice for guidance is crucial to choosing appropriate investment options for your risk profile and financial goals. It’s often advantageous to seek professional help, particularly for complex financial decisions.

Example: Retirement Planning

Imagine a mid-career professional aiming for early retirement. Their long-term financial analysis would include calculating the amount of money needed for retirement, considering their current lifestyle, desired retirement lifestyle, and projected expenses. This analysis would guide investment decisions to generate sufficient returns to meet their financial needs.

Adapting to Career Changes

Handling Job Transitions

Career changes often require adjustments to your financial planning. When switching jobs, re-evaluate your financial situation to adapt to the new income and expenses. Explore options to mitigate financial uncertainty during the transition phase and explore new career opportunities. This is especially critical when navigating job loss or a significant pay reduction.

Future Financial Implications of Career Choice

Considering the potential financial implications of your chosen career path is equally important. Research the average salary range and financial benefits associated with various career fields. Research and compare potential employers and their benefits packages. Align your career choices with long-term financial goals and ensure your career aligns with your financial aspirations. Factors like healthcare contributions, retirement plans, and paid time off are all significant contributors to your overall financial wellbeing and must be taken into consideration.

Integrating Financial Planning into Career Decisions

Aligning Goals

The key to successfully integrating financial planning into your career decisions is to make sure your goals are well-defined and aligned with your career choices. If your career path doesn’t match your financial goals, consider alternative or supporting strategies to bring them closer together.

Seeking Professional Advice

Seeking professional financial advice can provide tailored plans to help you navigate complex financial decisions. Consult financial advisors to gain insights into investment strategies and risk management. Financial advisors can provide tailored plans according to your specific circumstances, financial goals, risk profile, and more.

Conclusion

FAQ

What are the key considerations for developing a financial plan for a career change?

Developing a financial plan during a career change requires meticulous assessment of your current financial situation, encompassing income, expenses, and debts. Consider the expected income from your new position and evaluate the potential adjustments in your expenses. Analyzing the salary range of your target career paths is crucial for adjusting your financial expectations and aligning your budget with your new income. Long-term career and financial goals should be defined and regularly reviewed to ensure alignment with your evolving circumstances. Remember to consider the implications of each financial decision in line with your career changes.

How can a financial plan help to achieve long-term career goals?

A strong financial plan can support your long-term career goals by ensuring financial stability and security. By carefully budgeting, you can allocate funds for further education, skill development, or career advancement opportunities. A well-structured budget can enable you to build a substantial savings to manage unforeseen circumstances or make calculated career changes. Long-term financial planning can empower you to pursue higher education, take career-related training, or even consider starting your own business – all these steps can boost your career growth and success.

In summary, meticulously planning your finances is crucial for career success. A well-defined budget, alongside a realistic long-term financial analysis, provides the roadmap for achieving your career goals. By understanding your spending habits, identifying potential financial pitfalls, and focusing on long-term growth, you’re positioning yourself for a fulfilling and secure future. Take action today—start creating your personalized financial roadmap to maximize your career potential. This document served as a guide for your journey; always seek advice from a financial advisor for tailored plans.