Strategies for Managing Financial Aspects of Technology Startups Plan are crucial for the success of any innovative venture. A meticulously crafted financial strategy is not merely an afterthought; it’s the bedrock upon which a tech startup can build a strong foundation. This detailed guide explores the critical financial planning facets necessary for a successful technology venture, emphasizing how strategic planning and proactive budgeting can help your startup stand out in a highly competitive market. This article will examine essential elements from forecasting to funding, exploring various management strategies, while offering insights into managing costs and ensuring profitability. We’ll cover practical steps for achieving financial stability and sustainable growth. Here’s an overview of the critical areas we will discuss: understanding different funding options, strategic budgeting, cash flow management, and the importance of financial forecasting.

Understanding Funding Options for Technology Startups

Exploring Different Funding Avenues

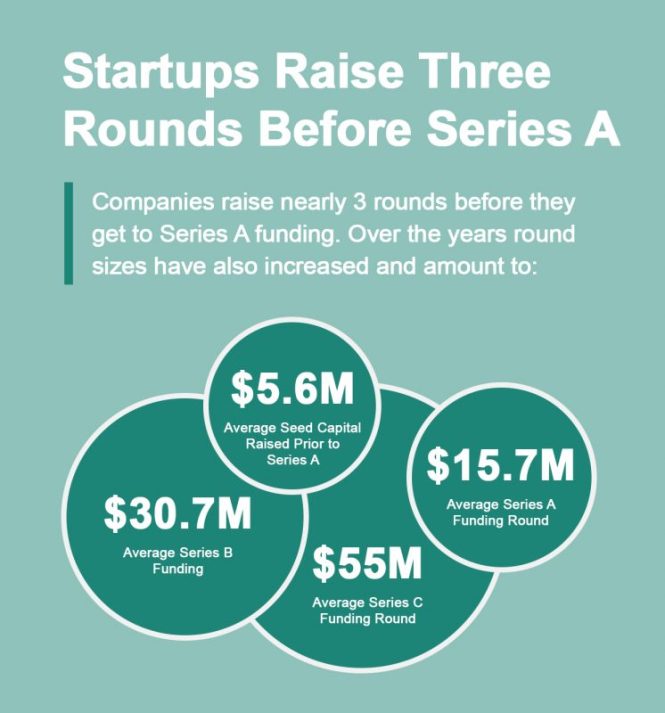

Launching a technology startup often requires significant upfront capital. Recognizing the various funding options available is paramount for startups aiming to secure initial capital and future growth. Bootstrapping, angel investors, venture capital firms, and crowdfunding represent significant paths for startups seeking capital. Each option has distinct characteristics and implications, impacting the ownership structure, control, and long-term financial obligations. Understanding these nuances allows founders to make informed decisions aligning funding sources with their specific needs.

Case Study: The Role of Angel Investors

A prominent example of how angel investors play a crucial role in the early stages is the successful trajectory of numerous tech startups. Consider the impact of angel investor support on numerous startups in the early stages of development. Their expertise and networks often provide invaluable guidance and resources beyond financial contributions.

Calculating Startup Costs

Determining the precise cost structure of a tech startup is an essential first step. Comprehensive cost analysis allows for a realistic budgeting process. Fixed costs, such as office rent and software subscriptions, and variable costs, contingent on sales volume, must be clearly delineated. Entrepreneurs should meticulously track all expenses, ensuring every expenditure aligns with the startup’s goals.

Strategic Budgeting for Startups

Developing a Realistic Budget

A meticulously crafted budget acts as a roadmap, guiding the allocation of resources to different facets of the startup’s operations. A realistic budget encompasses all potential expenses, including operational costs, marketing initiatives, and research and development. By establishing a clear budget, the startup team can prioritize expenditures, track progress against projections, and anticipate any potential financial challenges.

Aligning Budgets with Milestones

Startups should connect their budgets with specific milestones, creating checkpoints for monitoring progress and making necessary adjustments as required. This dynamic approach reflects the inherent adaptability required in the fast-paced tech startup environment. This iterative process ensures financial stability as the startup scales.

Cash Flow Management for Startups

Proactive Cash Flow Forecasting

Maintaining a healthy cash flow is vital for survival and growth. Proactive forecasting allows startups to anticipate potential shortfalls and surpluses, thereby mitigating risks and optimizing resource allocation. By tracking income and expenditure, startups can identify trends, making informed decisions about investments and expenses. This proactive approach enables proactive measures and minimizes the impact of financial hiccups.

Utilizing Financial Forecasting Tools

Various financial tools aid in effective cash flow management. Spreadsheets, dedicated startup software, and specialized financial forecasting services can assist founders in tracking cash inflows and outflows. These tools facilitate a clearer understanding of financial projections and resource allocation.

Financial Forecasting and Its Impact on Startups

Creating Financial Projections

Financial forecasting provides a roadmap for future financial performance. By anticipating potential income streams, expenses, and cash flow fluctuations, startups can make informed decisions regarding resource allocation, investment strategies, and growth plans. Understanding potential future scenarios is vital for navigating market dynamics and ensuring financial sustainability. Accurate projections often lead to more confident decision-making.

Utilizing Scenario Planning for Robust Strategies

Scenario planning is a valuable tool for startups anticipating various market conditions. By exploring multiple possible outcomes, startups can develop more comprehensive and adaptive strategies for handling diverse financial scenarios. This preparedness allows them to react effectively to changes in market conditions.

Importance of Cost-Effective Strategies for Startups

Optimizing Operational Costs

In the competitive landscape of technology startups, operational costs play a significant role in long-term profitability. Startups should carefully examine and optimize operational costs by evaluating potential savings in areas such as office space, utilities, and communication. Proactive cost optimization strategies can improve profitability and efficiency.

Leveraging Technology for Efficiency

Leveraging technology for improved efficiency is a vital strategy for minimizing costs. Exploring cost-effective technologies and automation tools can streamline workflows, reduce labor costs, and improve overall output. Adopting these practices allows resources to be allocated more efficiently.

Securing Funding and Maintaining Financial Health

Diverse Funding Options for Growth

Various avenues for securing funding are crucial for maintaining financial stability and fostering growth. Beyond traditional venture capital, exploring alternative funding options, such as crowdfunding and grants, can provide innovative ways to augment financial resources.

Evaluating Financial Health Metrics

Evaluating essential financial health metrics, such as revenue projections, cash flow, and profitability, is vital for determining the startup’s overall financial health. These analyses provide insight into how well the financial strategy is working.

The Role of Financial Advisors in Startup Success

Leveraging External Expertise

Engaging financial advisors who understand the unique challenges of technology startups is a prudent strategy. Their expertise can be invaluable in ensuring financial stability and growth. These advisors can provide insights, financial modeling, and actionable strategies.

Developing Strategic Partnerships

Developing strong strategic partnerships with financial institutions and investors is a significant factor in securing funding and maintaining financial stability. These partnerships are essential to fostering trust and confidence, creating a pathway for long-term sustainability.

Long-Term Financial Planning for Sustainability

Creating Sustainable Strategies for Growth

Strategic financial management should encompass long-term projections. Startups need to ensure they can maintain financial viability and growth over the long haul. Proactive planning allows for the ability to adapt and adjust to market conditions.

Developing Robust Financial Models

Developing robust financial models allows startups to create realistic financial forecasts. Regular review of these forecasts and a willingness to adapt to market conditions are critical to sustaining a growth trajectory.

Important Considerations When Budgeting for Technology Startups

Maintaining Financial Flexibility

Financial flexibility is crucial to navigating unexpected circumstances and pivoting strategies. This preparedness minimizes the impact of unexpected challenges and allows startups to adapt quickly to new developments in the technological landscape.

Adapting to Market Changes

Startups should be attuned to potential market changes. Flexibility in their financial strategies ensures that they can adjust their plans to accommodate external factors. This adaptive ability allows them to maintain a robust and evolving financial model. This proactive measure minimizes financial instability and maximizes the chances of success in the industry. Regular analysis and review, therefore, are vital to mitigate market risks and optimize financial decisions continuously. This adaptation process allows for greater sustainability in the fast-paced market for technology startups and fosters resilience. These considerations should be integrated into the startup’s overarching strategy for continued success and growth, as well as a commitment to financial health and stability in a competitive market. Understanding the competitive landscape and how factors such as market volatility and shifts in consumer demand might affect the financial projections will also be key. The overall financial plan, therefore, needs ongoing review and adaptation, as well as a keen understanding of broader market trends, to allow startups to maintain financial stability and sustainability, fostering long-term viability in their chosen markets, industries, and innovation niches.

In conclusion, strategic financial management is crucial for the success of any technology startup. By proactively forecasting cash flow, securing funding, and implementing cost-effective strategies, startups can increase their chances of profitability and long-term viability. This article has provided a comprehensive overview, equipping you with the essential tools and knowledge to navigate the financial landscape effectively. To delve deeper into these strategies, I encourage you to explore our resources and related content on our website.