Financial statements are the backbone of any successful business. They provide a snapshot of a company’s financial health, revealing strengths, weaknesses, and areas needing immediate attention. Understanding how to analyze these statements is essential for developing strategic improvement plans that drive growth and profitability.

Mastering the art of financial statement analysis empowers businesses to make informed decisions, identify problems before they escalate, and develop effective strategies to enhance their performance.

To begin, delve into the income statement. This report details a company’s revenues, expenses, and net income over a specific period. Key metrics to scrutinize include revenue growth, cost of goods sold, operating expenses, and net profit margin. Notice trends in revenue and expenses over time—are they increasing or decreasing? Are there specific expense categories that are unusually high?

Next, scrutinize the balance sheet. This snapshot captures a company’s assets, liabilities, and equity at a specific point in time. Pay close attention to the current ratio (current assets divided by current liabilities) and the debt-to-equity ratio. A declining current ratio or an increasing debt-to-equity ratio could indicate potential liquidity or solvency issues.

The cash flow statement is equally vital. It tracks the movement of cash both into and out of the business. Analyzing cash flow helps you understand if the business is generating enough cash to meet its obligations. Positive cash flow from operations is a good sign, while negative cash flow may indicate issues requiring immediate attention.

Using these crucial statements, establish a framework for improvement. Identify any discrepancies or patterns that could indicate trouble. For instance, declining profitability may stem from rising operating costs or a decrease in sales. High inventory levels might imply inefficiencies in inventory management, while high debt levels could mean a need for cost-cutting measures.

In tandem with statement analysis, consider the industry benchmarks. How does your company perform against its competitors? Do you see noteworthy differences in metrics like profit margins? This comparative analysis can highlight areas where improvements are possible and provide a clearer picture of your position in the market.

Beyond individual metrics, look for correlations. Are declines in sales linked to specific marketing campaigns? Are increases in inventory levels tied to order fulfillment delays? Understanding these connections often unlocks the root cause of problems, leading to more effective solutions.

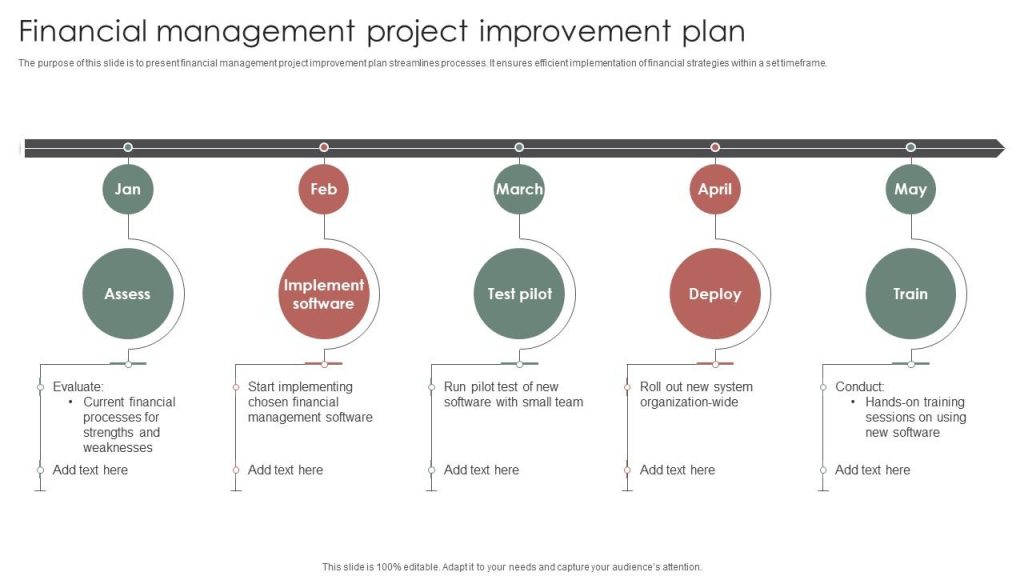

Once you’ve identified areas for improvement, develop a specific action plan. This plan should clearly outline the steps you’ll take to address each issue. For example, if rising operational costs are the problem, the plan might entail negotiating better deals with suppliers, streamlining processes, or investing in new technologies to improve operational efficiency.

Employing sound accounting principles is critical. Accurate and transparent accounting practices are fundamental to providing reliable financial statements. Ensure your team is well-versed in these standards to maintain the integrity of your financial data, which is essential in identifying problem areas and making well-informed decisions about improving the business’s overall performance. Remember that the insights gained from analyzing financial statements can serve as a valuable tool in strategic decision-making, ultimately leading to greater profitability and growth for your company. Understanding the nuances of financial statements is a vital asset in guiding your business towards sustained success in the ever-evolving marketplace and beyond. Using these guidelines and adopting a consistent analytical approach will equip you to tackle financial challenges head-on and build a stronger, more profitable future for your business. So, embrace the power of financial statement analysis, and watch your business thrive as you take steps toward its continued success. Furthermore, by consistently monitoring and evaluating financial data, businesses can more effectively forecast potential challenges and adopt proactive measures that ensure sustained growth and stability in the face of ever-changing market conditions. Furthermore, a thorough understanding of financial statements, including its various aspects and detailed accounting practices, are vital for navigating the ever-changing marketplace and achieving sustained success. A deeper dive into the nuances of each statement and its implications for the business is a cornerstone for long-term growth. By embracing this analytical framework, you arm your business with the resources to not only stay afloat but excel in the competitive market. Regular evaluation and improvement of your financial statement analysis will ensure your organization is fully prepared to navigate any obstacle and maintain a sustainable competitive edge. Always remember to consult with financial professionals for guidance specific to your business needs and circumstances. This will help you navigate the financial landscape with confidence, optimizing your decision-making process and ultimately fostering long-term success for your business endeavors. This is essential in ensuring all necessary components are considered before making key financial choices. Also, consider consulting an accounting professional for specialized financial statement analysis and guidance for your specific situation and industry standards. This is crucial for a comprehensive understanding of the intricate dynamics involved and to ensure compliance with accounting regulations. Also, make sure you understand how to read financial statements, what to watch out for, and other crucial aspects involved before applying this approach to your business operations. Do not hesitate to utilize external expert advice on matters related to financial analysis, or accounting for better accuracy and success within your organization and for better decisions on the company’s future. It is wise to remember that the consistent use of correct procedures and methods, and compliance with established accounting regulations and policies is paramount for financial statement analysis. Constantly evaluating your company’s performance against its benchmarks, industry standards, and peers is also an important step in identifying key areas for improvement and strengthening your overall competitive advantage.

Analyzing financial statements is crucial for identifying areas needing improvement in a business. By understanding key financial metrics and trends, you can proactively address potential issues and optimize your financial strategies for sustained growth. Regular analysis and strategic planning based on these findings are essential for long-term success.