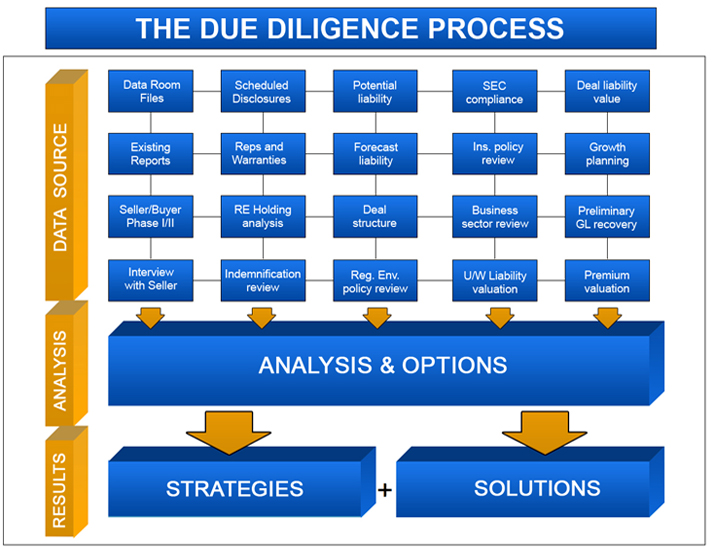

The key to successful cross-border mergers and acquisitions (M&A) lies in robust due diligence. Imagine a meticulously crafted investigation, uncovering hidden liabilities and opportunities before a deal is finalized. This thorough examination minimizes risks and sets the stage for a seamless integration. Due diligence is a crucial process in cross-border transactions, ensuring that both companies understand the implications of a merger or acquisition before committing to the deal. This process often involves careful analysis of financial statements, legal compliance, regulatory landscape, and operational aspects of the target company. This comprehensive guide will delve into the critical steps of due diligence in cross-border mergers and acquisitions, providing insights for a successful integration and mitigating potential pitfalls. We will explore critical areas such as financial modeling, legal compliance, regulatory considerations, and cultural integration, highlighting the practical implications and common challenges involved in each phase.

Understanding the Significance of Due Diligence

Defining Due Diligence in Cross-Border M&A

Due diligence, in the context of cross-border M&A, is the meticulous process of evaluating a potential target company before a merger or acquisition. It’s a comprehensive investigation spanning various aspects of the target company’s operations, finances, and legal compliance, crucial to understanding the true value and risks associated with the transaction. This step is imperative as it helps to identify hidden liabilities and potential future complications. It’s about minimizing risk and maximizing value for all parties involved. A thorough understanding of legal and regulatory frameworks is essential, given the international nature of the transaction. A well-conducted due diligence process can reveal potential conflicts of interest or unusual financial practices that might not be apparent on the surface.

Comprehensive Financial Analysis

Assessing Financial Statements

A vital aspect of due diligence involves a detailed examination of the target company’s financial statements. This includes an in-depth review of financial records, cash flow statements, and profit and loss statements. Analyzing historical trends and future projections can provide insight into the long-term stability and potential profitability of the acquisition. Financial modeling plays a critical role here, projecting future performance and determining the financial feasibility of the acquisition. A thorough analysis of financial statements, including projections and assumptions, is vital for forecasting potential risks and returns on investment.

Evaluating Financial Health

Thorough financial analysis is essential to understand the target company’s financial health. Assessing liquidity, solvency, and profitability indicators provides critical insights into the company’s financial stability. For instance, a significant amount of accounts payable or high levels of debt may indicate financial strain, impacting the deal’s feasibility. Identifying and quantifying these risks early allows for informed decision-making and negotiation terms that reflect the true value.

Legal and Regulatory Scrutiny

Navigating Complex Legal Landscapes

Navigating legal and regulatory environments across borders is a crucial part of due diligence in cross-border M&A. This involves legal and regulatory compliance in multiple jurisdictions, which can differ considerably. Understanding local regulations, including tax laws, environmental regulations, and labor laws, is vital. This requires legal experts with experience in the target company’s jurisdictions. For example, differences in intellectual property protection or labor laws could introduce significant liabilities. This critical step minimizes legal and regulatory risks associated with the deal.

Addressing Intellectual Property Issues

A critical component in due diligence is examining the target company’s intellectual property. This includes reviewing patents, trademarks, and copyrights to ensure their validity and enforceability. Identifying any potential IP issues, like possible infringements, can save substantial costs and headaches later. This careful scrutiny avoids disputes and legal entanglements in the future.

Operational Due Diligence

Analyzing Operational Efficiency

Operational due diligence is essential for assessing the target company’s efficiency and internal controls. This involves reviewing internal processes, systems, and procedures. This comprehensive assessment of the target company’s operational structure can identify inefficiencies that could create delays or financial burdens. Understanding operational efficiency helps to establish realistic integration timelines. For example, evaluating the target company’s supply chain and logistics can uncover hidden costs or inefficiencies in their operations.

Assessing Cultural Integration

Mergers and acquisitions often involve combining different cultures and workforces. Cross-cultural due diligence is critical to understanding potential cultural integration challenges. Understanding organizational structures and management styles, as well as work ethic, can help to prepare for potential conflicts in integrating the two companies. This assessment can create a more effective merger process.

Tax Due Diligence

Assessing Tax Implications

Tax implications are a major consideration in cross-border M&A transactions. Due diligence must thoroughly examine the target company’s tax liabilities, compliance, and potential tax risks in both the acquiring and target jurisdictions. This includes understanding tax laws and rates applicable to the deal in multiple jurisdictions.

International Tax Strategies

Developing a sound tax strategy is essential. Understanding and planning for tax obligations in both jurisdictions allows for informed decision-making and effective negotiation strategies to optimize outcomes. A comprehensive tax analysis should also consider the potential for tax implications in the target company’s country.

In conclusion, meticulous due diligence is the cornerstone of successful cross-border mergers and acquisitions. By proactively identifying potential risks, understanding the target company’s operations, and navigating legal and regulatory landscapes, businesses can increase their chances of a profitable and smooth transaction. Always remember to seek expert advice throughout the process. Want to unlock the secrets to a seamless cross-border M&A? Download our free guide on due diligence strategies today!